Smart contracts have emerged as a revolutionary technology, bringing efficiency, transparency, and security to various industries. In trade finance, where complex transactions and paperwork often hinder smooth processes, smart contracts offer a promising solution. By leveraging blockchain technology and automation, these self-executing contracts streamline financing processes while reducing risk and enhancing overall efficiency. To effectively invest and trade crypto like Bitcoin, you may visit the Home page of the most reliable trading platform online.

Introduction

Smart contracts, as the name suggests, are programmable agreements that automatically execute predefined terms and conditions. These contracts are built on blockchain networks, which provide a secure and immutable ledger of transactions. In the context of trade finance, smart contracts have the potential to streamline financing processes, reduce paperwork, and mitigate fraud and risk.

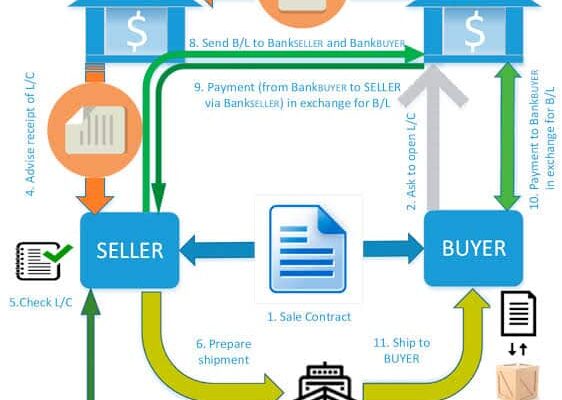

Trade finance involves providing financial instruments and services to facilitate international trade transactions. However, traditional trade finance processes are often cumbersome, time-consuming, and prone to errors and fraud. By incorporating smart contracts into trade finance, organizations can overcome these challenges and achieve faster, more secure, and efficient transactions.

Benefits of smart contracts in trade finance

Increased efficiency and automation

One of the key advantages of smart contracts in trade finance is the automation of manual processes. Traditional trade finance involves multiple intermediaries, extensive documentation, and time-consuming verification procedures. Smart contracts automate many of these tasks, enabling faster processing, reduced human error, and enhanced efficiency throughout the financing process.

Enhanced transparency and security

Smart contracts operate on a decentralized blockchain network, providing increased transparency and security. Every transaction and agreement recorded on the blockchain is immutable and visible to all participants, reducing the possibility of fraud and manipulation. This transparency helps build trust among stakeholders and simplifies auditing and compliance processes.

Reduced fraud and risk

Trade finance transactions are often vulnerable to fraudulent activities and disputes. Smart contracts address this challenge by automating payment and settlement processes. Transactions are executed only when predefined conditions are met, ensuring that goods are delivered, and payments are made accordingly. This reduces the risk of non-payment, non-delivery, and disputes, making trade finance more secure and reliable.

Streamlining financing processes with smart contracts

Streamlining financing processes with smart contracts involves automating payment and settlement procedures, digitizing documentation and verification, and eliminating intermediaries. Smart contracts enable automated payment execution based on predefined conditions, reducing manual intervention and settlement time. They digitize and automate document management, ensuring secure storage, verification, and compliance. By eliminating intermediaries, smart contracts simplify processes, reduce costs, and increase transaction speed. These streamlined processes enhance efficiency, transparency, and security in trade finance transactions.

Challenges and considerations

While smart contracts offer significant advantages in trade finance, there are challenges and considerations that need to be addressed for widespread adoption:

Technical limitations and scalability: Smart contracts rely on blockchain technology, which currently faces scalability and performance issues. As trade finance involves a large volume of transactions, the scalability of blockchain networks needs to be improved to accommodate the growing demand.

Legal and regulatory hurdles: The legal and regulatory landscape surrounding smart contracts in trade finance is still evolving. Ensuring compliance with existing laws and adapting regulations to accommodate this technology require close collaboration between industry stakeholders, policymakers, and legal experts.

Adoption and standardization: The successful adoption of smart contracts in trade finance relies on widespread acceptance and standardization of protocols and frameworks. Industry-wide collaboration and agreement on common standards will facilitate interoperability and integration among different platforms and systems.

Case studies showcasing successful implementation

Case studies showcasing successful implementations of smart contracts in trade finance demonstrate their practical benefits and potential for widespread adoption. These examples highlight how smart contracts streamline processes, improve efficiency, and enhance security.

One case study involves a global trade finance platform that integrates smart contracts, automating the issuance and management of trade finance instruments. This implementation eliminates manual processes, reduces paperwork, and accelerates transaction cycles, benefiting all participants.

Another case study focuses on a decentralized letter of credit (LC) system based on smart contracts. By automating the LC process, this implementation reduces the risk of fraud and disputes, enhances transparency, and accelerates payment processing.

Conclusion

In conclusion, smart contracts in trade finance bring automation, transparency, and security to financing processes. They streamline transactions, reduce complexities, and mitigate risks. By automating payment and settlement, digitizing documentation, and eliminating intermediaries, smart contracts enhance efficiency and trust in trade finance. While challenges exist, such as technical limitations and regulatory considerations, the future prospects for smart contracts in trade finance are promising. Integration with emerging technologies and industry-wide collaboration will further drive their adoption and pave the way for faster, more secure, and efficient trade transactions.